CVNB Checking

With a CVNB personal checking account, you get the tools and features to make banking simple and rewarding. Manage your money with secure online and mobile banking, plus enjoy perks that help you save time, protect your finances, and get more from your bank.

Whether you are handling day-to-day spending or planning for the future, our accounts are designed to fit your lifestyle and keep you in control.

Open your checking account today and experience banking made better!

Online Banking

Enjoy 24/7 access to your account from any computer with an internet connection through online banking.Mobile Banking

Manage your money on the go—check balances, transfer funds, pay bills, and deposit checks with mobile banking.

Bill Pay

Stay on top of your payments by scheduling and paying bills directly from your account with bill pay.

eStatements

Reduce paper clutter and access your statements securely online by enrolling in eStatements.

Debit Card

Use your complimentary debit card anywhere Mastercard® is accepted for fast, secure purchases.

Zelle®

Send and receive money easily with people you trust using Zelle®, a safe and convenient way to move money.

Choose a Checking Account That Fits Your Life!

- $100 Opening Deposit

- $100 Minimum Balance

- Free eStatement or $3 Paper Statement (per cycle)

- Overdraft Protection

(subject to eligibility)** - Checks Available for Purchase

- Must be 18 or over

- $8/Month Fee1

• Monthly fee waived with $100 minimum balance AND 12 debit card purchase transactions.

- $100 Opening Deposit

- No Minimum Balance

- Up to 2-Day Early Direct Deposit2

- Earn $2 Cash Back when 12 Debit Card Purchases of $5 or More Post and Clear Each Statement Cycle

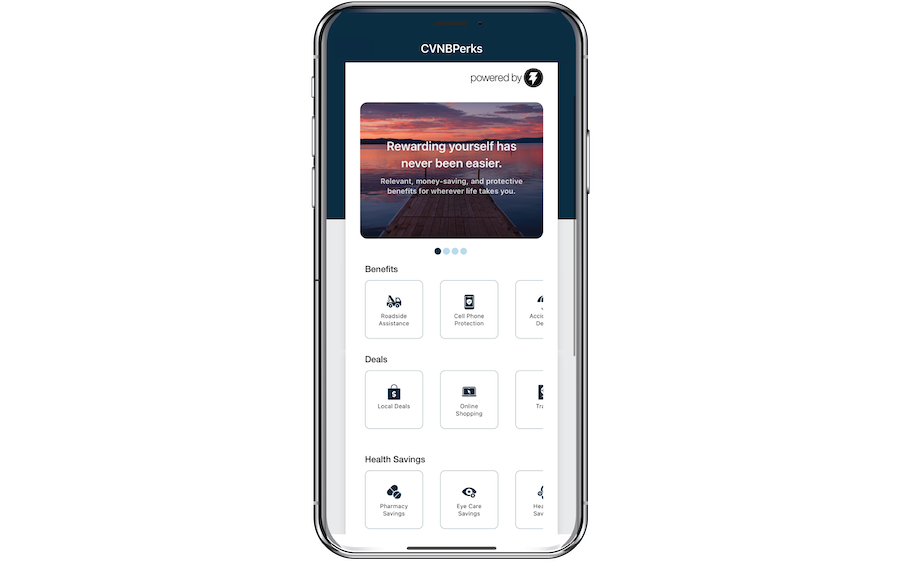

- CVNBPerks Powered by BaZing

- Free Paper or eStatement

- ATM Fee Waived for Use of

Non-CVNB ATM (owner of ATM may charge a fee) - Overdraft Protection (subject to eligibility)**

- 50% Discount on CVNB Custom Checks (when ordered through CVNB)

- Safe Deposit Box Free First Year, with Direct Payment3

- Must be 18 or Over

- $7/Month Fee4

• $2 cash back per cycle for primary account holders age 62 or older

- $2,500 Opening Deposit

- $2,500 Minimum Balance

- Earn Interest*

• Balances from $1,000.00 to $9,999.99 APY 1.26%. Balances from $10,000.00 or more APY 1.51% - Up to 2-Day Early Direct Deposit2

- Earn 2% Cash Back on Debit Card Purchases Up to $6 Per Statement Cycle (up to $72 annually)

- CVNBPerks Powered by BaZing

- Free Paper or eStatement

- ATM Fee Waived for Use of

Non-CVNB ATM (owner of ATM may charge a fee) - Complimentary Cashier's Checks and Photocopies of Checks and Statements

- Overdraft Protection

(subject to eligibility)** - 50% Discount on CVNB Custom Checks (when ordered through CVNB)

- Safe Deposit Box Free First Year, with Direct Payment3

- Must be 18 or Over

- $10/Month Fee5

• Monthly fee waived with $2,500 minimum balance AND 1 ACH direct deposit

- $50 Opening Deposit

- No Minimum Balance

- Earn Interest*

- Free Paper or eStatement

- ATM Fee Waived for Use of

Non-CVNB ATM (owner of ATM may charge a fee) - Overdraft Protection

(subject to eligibility)** - Checks Available for Purchase

- Must be 62 or Over

- $0/Month Fee

- $25 Opening Deposit

- No Minimum Balance

- $0/Month Fee

- Free eStatement or $3 Paper Statement (per cycle)

- Complimentary Debit Card6

- No Overdraft Protection

- Checks Available for Purchase

- Parent or Guardian Monitoring and Deposit Tools Available

- Must be 13 - 17 Age Range7

- $0/Month Fee

- $50 Opening Deposit

- No Minimum Balance

- Free eStatement or $3 Paper Statement (per cycle)

- No Overdraft Protection

- Checks Available for Purchase

- Must be 18 or Over

- $10/Month Fee8

• $2 cash back when 1 ACH direct deposit post to the account per statement cycle, lowering the monthly fee to $8

Shop Local, Save Local1

ID Theft Aid2,3,4

- Personal Identity Theft Benefit: Receive up to $2,500 reimbursement for covered expenses you incur to restore your identity.

- Identity Restoration and Payment Card Resolution: Identity restoration specialist works on your behalf to restore your identity, and cancel payment cards.

- Credit Monitoring and Credit Report: Monitor changes and new activity on your credit report and review your credit report quarterly.

- Credit Score and Score Tracker: View your credit score online and track trends on your dashboard. Score Simulator: Estimate how much impact one particular action could have on your credit health.

- Identity Monitoring: Monitors the dark web to identify activity associated with your identity, including public records, change of address, social security, and non-credit loans.

Cell Phone Protection2,3

Health Savings Card

Roadside Assistance

Billshark4

Pet Insurance4

Accidental Death & Dismemberment Insurance3

2 Subject to the terms and conditions detailed in the Guide to Benefits.

3 Insurance products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK.

4 Requires additional activation to begin.

Access CVNBPerks Benefits in the CVNB Mobile Banking App!

or call 1.800.999.3126 to start enjoying your perks.

3 Free 2X5 or 3X5 Safe Deposit Box or 50% off 3X10 or larger, for first year, if enrolled direct payment.

4 Primary account owners age 62+ earn $2 cash back each cycle, lowering the monthly fee to $5.

5 To get the $10 monthly fee waived each statement cycle, maintain a daily balance of $2,500 AND have 1 ACH direct deposit post to your account.

6 Default limits set at $400 POS and $100 ATM Withdrawal. Limit adjustments may be requested by the parent or guardian.

7 Teen is the primary owner. Must have a parent or guardian as a joint account owner. Teen Money Account will automatically convert to CVNB’s The Cumberland Basic on the 5th business day of the calendar month following the teen’s 18th birthday.

8 Receive a $2 statement credit when 1 ACH direct deposit post during the statement cycle.