-2.jpg)

Experience the Benefits of CVNB Checking

With a personal checking account from CVNB, you have the freedom to bank your way, with smart digital tools, valuable features, and exclusive benefits tailored to your lifestyle. Whether you're managing everyday spending or planning ahead, we make it easier to stay in control of your finances.

Explore our flexible account options built to meet your everyday needs. Each one includes secure online and mobile banking, plus unique perks that help you get more from your money and more from your bank.

Open your account today and experience a better way to bank!

✔

Better Perks

✔

Better Benefits

✔

Better Service

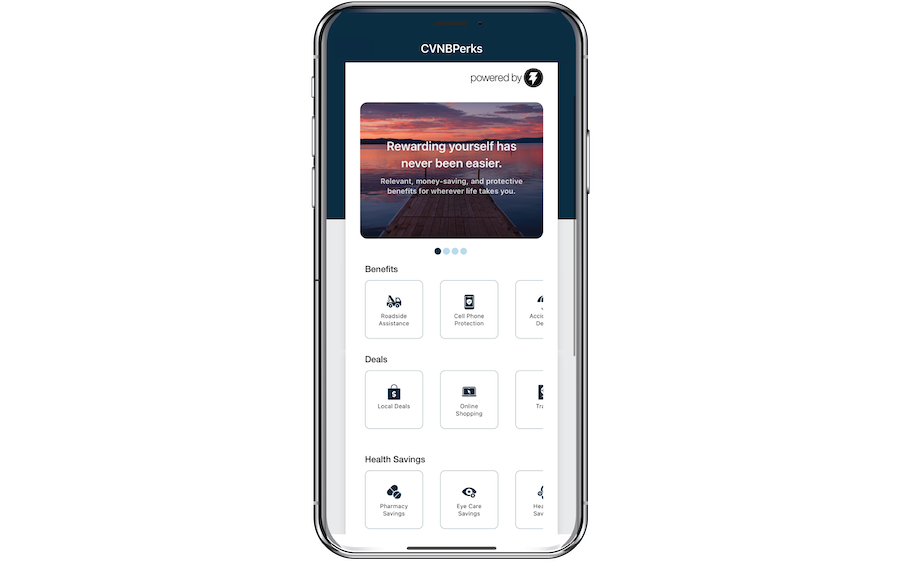

CVNBPerks Powered by BaZing

Big Money, Smart Savings

CVNBPerks is available exclusively with our Cumberland Plus and Cumberland Signature accounts.

- Shop Local, Save Local1

Local discounts and national retailer deals to save you money on shopping, dining, travel & more. - Health Savings Card

Save money on prescriptions, eye exams, frames, lenses and hearing services - Cell Phone Protection2,3

Pay your cell phone bill with your BaZing checking account, and you’re covered. We’ll pay to have it repaired or replaced, up to $600 per claim (maximum of $1,200 per year). - Roadside Assistance

Available 24/7 and free to use, covers up to $80 in covered service charges. - ID Theft Aid2,3,4

- Personal Identity Theft Benefit: Receive up to $2,500 reimbursement for covered expenses you incur to restore your identity.

- Identity Restoration and Payment Card Resolution: Identity restoration specialist works on your behalf to restore your identity, and cancel payment cards.

- Credit Monitoring and Credit Report: Monitor changes and new activity on your credit report and review your credit report quarterly.

- Credit Score and Score Tracker: View your credit score online and track trends on your dashboard. Score Simulator: Estimate how much impact one particular action could have on your credit health.

- Identity Monitoring: Monitors the dark web to identify activity associated with your identity, including public records, change of address, social security, and non-credit loans.

- Accidental Death & Dismemberment Insurance3

$10,000 in Accidental Death & Dismemberment Insurance. Peace of mind for the unexpected. - Billshark4

Let our team of experts negotiate your internet, TV, cell phone, and home security services on your behalf, or cancel subscriptions you no longer want or need. - Pet Insurance4

Preferred rates on pet insurance. Coverage includes free ID tags linked in pet cloud, 24/7 virtual vet, pet RX and more!

1 Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions, and may choose to limit deals. 2 Subject to the terms and conditions detailed in the Guide to Benefits. 3 Insurance products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK. 4 Requires additional activation to begin.

Access CVNBPerks Benefits in the CVNB Mobile Banking App!

Visit your local CVNB branch or call 800-999-3126 to activate your CVNBPerks benefits and start enjoying your perks!

* Variable rates are subject to change. The Cumberland Signature requires a minimum balance of $1,000 to earn interest.

**Please see our Overdraft Protection Policy for full details.

1 The $8 monthly fee is waived each statement cycle when the account maintains a $100 minimum daily balance AND 12 debit card purchases of $5 or more post and clear the account per statement cycle.

2 Timing of when an ACH direct deposit is credited is based on when the payer submits the information to us. This means when these transactions are credited could vary and you may not receive your funds early.

3 Free 2X5 or 3X5 Safe Deposit Box or 50% off 3X10 or larger, for first year, if enrolled direct payment.

4 Primary account owners age 62+ earn $2 cash back each cycle, lowering the monthly fee to $5.

5 To get the $10 monthly fee waived each statement cycle, maintain a daily balance of $2,500 AND have 1 ACH direct deposit post to your account.

6 Default limits set at $400 POS and $100 ATM Withdrawal. Limit adjustments may be requested by the parent or guardian.

7 Teen is the primary owner. Must have a parent or guardian as a joint account owner. Teen Money Account will automatically convert to CVNB’s The Cumberland Basic on the 5th business day of the calendar month following the teen’s 18th birthday.

8 Receive a $2 statement credit when 1 ACH direct deposit post during the statement cycle.

3 Free 2X5 or 3X5 Safe Deposit Box or 50% off 3X10 or larger, for first year, if enrolled direct payment.

4 Primary account owners age 62+ earn $2 cash back each cycle, lowering the monthly fee to $5.

5 To get the $10 monthly fee waived each statement cycle, maintain a daily balance of $2,500 AND have 1 ACH direct deposit post to your account.

6 Default limits set at $400 POS and $100 ATM Withdrawal. Limit adjustments may be requested by the parent or guardian.

7 Teen is the primary owner. Must have a parent or guardian as a joint account owner. Teen Money Account will automatically convert to CVNB’s The Cumberland Basic on the 5th business day of the calendar month following the teen’s 18th birthday.

8 Receive a $2 statement credit when 1 ACH direct deposit post during the statement cycle.